3 Reasons Why the 71lbs Shipping Dashboard Rocks!

"I’ve been on the FedEx (or insert UPS here as well) site for the last 20 minutes and cannot figure out what my last quarter’s shipping costs is" - we hear this often, sadly, too often, from our customers. This has resonated with us for decades now, first as FedEx and UPS customers trying to navigate cumbersome, boring(!), and inefficient AS-400 type screens and reports, to now being on the other side of the shipping table, where 71lbs helps thousands of companies be their shipping advocate. So in true engineering/mad scientist/business mode, we decided to build a better solution.

- Easy and simple

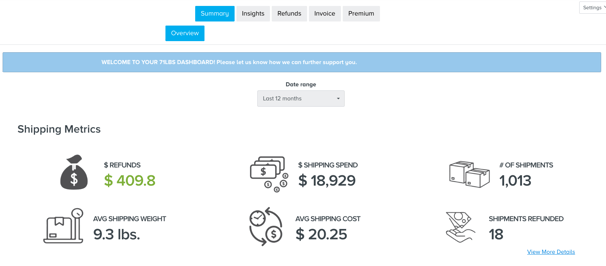

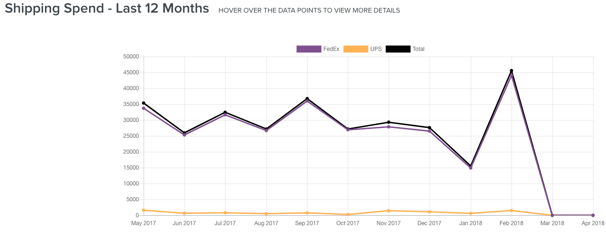

Our customers tell us that they LOVE how easy and simple the 71lbs dashboard is. Our dashboard allows customers to view key important metrics - shipping spend, average shipping cost, average shipping weight, among others, all of which can be queried by specific date ranges.

- A picture is worth a thousand words.

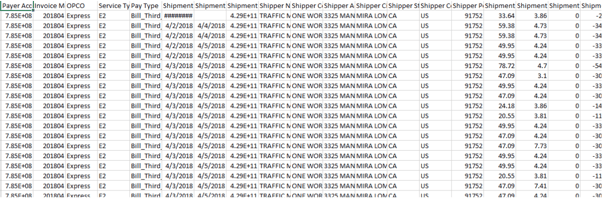

It still amazes us why after so many decades the shipping carriers do not provide better reporting. Guess you can get away with this when you only have 1.5 competitors.

Would you rather see this...

Or this?

We believe a picture (or a graph) is a worth more than a 1,000 words (or customized data points!).

- Apples-to-apples comparisons.

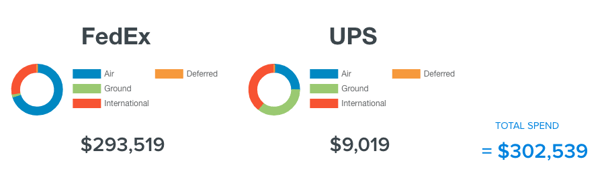

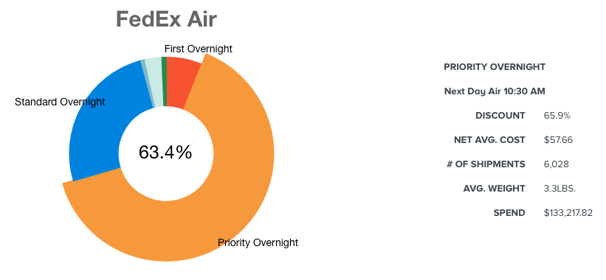

In our experience, 35% of companies ship with both FedEx and UPS. Having the ability to compare metrics side-by-side ranks high on the list of customer needs. Our customized dashboard displays an easy-to-understand view of their spend, by air, ground, international, down to specific service types.

Behind the scenes, our system aggregates and simplifies the carriers’ data. We have mapped the 254 UPS data fields with FedEx’s hundreds of fields to make the complex, simple.

Here is an example of shipping discounts, which allows customers to make more informed business decisions.

For example, the CFO of a company asks their shipping manager why they are are shipping more with UPS than FedEx—especially if their FedEx discounts seem higher. Our discounts tool helped the CFO and shipping manager identify scenarios (i.e. vender-led orders) where shipping with UPS made more sense monetarily. They then tweaked their practice to start shipping their remaining orders via FedEx, as their discounts proved more favorable to their shipping habits.

We are releasing an upgraded version of our dashboard in the next couple of weeks, so stay tuned as we continue on our mission to democratize shipping and logistics for small and medium sized companies.